The court ruled that the order, issued by the Additional Commissioner of Income Tax (OSD), was invalid as it lacked proper authorisation from the CBDT.

In Short

- Bombay High Court quashes income tax order against ND's Art World

- Order lacked CBDT authorisation, court rules

- Court directs CBDT to reconsider within three months

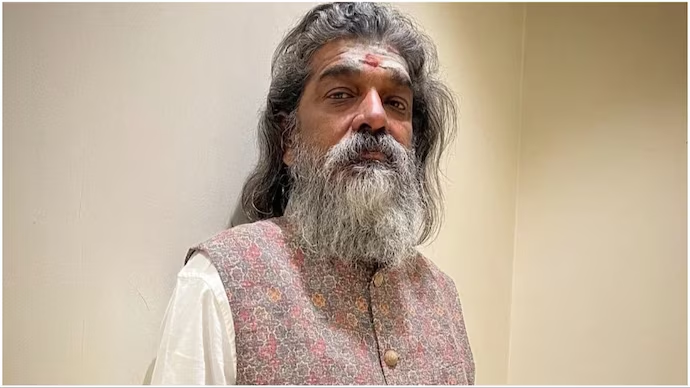

The Bombay High Court on Friday quashed an Income Tax order against ND’s Art World Private Limited, the company of late art director Nitin Desai.

Directing the Central Board of Direct Taxes (CBDT) to reconsider the case, the court ruled that the order, issued by the Additional Commissioner of Income Tax (OSD), was invalid as it lacked proper authorisation from the CBDT.

The case is in connection with a 10-month delay in filing the company’s income tax return for the assessment year 2020-21. ND’s Art World had sought condonation of the delay, citing hardships caused by the Covid-19 pandemic. However, the tax authorities rejected the plea, prompting the company to approach the court.

The bench of Justices MS Sonak and Jitendra Jain ruled that the order was not issued by the CBDT, the competent authority under Section 119(2)(b) of the Income Tax Act, 1961. The petitioner’s counsel, Priyanka Jain, argued that the order lacked clear approval from the CBDT or its members and that similar delays had been condoned in other cases due to pandemic-related challenges.

The bench of Justices MS Sonak and Jitendra Jain ruled that the order was not issued by the CBDT, the competent authority under Section 119(2)(b) of the Income Tax Act, 1961. The petitioner’s counsel, Priyanka Jain, argued that the order lacked clear approval from the CBDT or its members and that similar delays had been condoned in other cases due to pandemic-related challenges.

However, the court found that the order was not properly authorised and cited past rulings that invalidated similar decisions made without the CBDT’s direct involvement.

The court directed the CBDT or its duly authorised member to reconsider the case and issue a reasoned order within three months, after giving the petitioner an opportunity to present its case. All contentions on the merits of the case remain open for further consideration.

The court’s decision provides temporary relief to ND’s Art World, highlighting the importance of proper authorisation in tax-related decisions and the impact of pandemic-related challenges on businesses

Source: India Today